The world of finance is changing quickly, as is the need for professionals who can assist individuals in managing their finances, plan their financial future, and establish the foundation for financial stability over time. As concerns about inflation are rising, digital banking expands, and awareness of financial issues grows, jobs in personal financial management are now among the most stable and well-paying careers available today.

No matter if you’re just beginning your career or making plans for an upgrade, this thorough guide provides the top careers, roles, and skills required, as well as certifications and salary expectations. It also outlines future trends that will shape the job market for personal finance for 2025, and even beyond.

Why Jobs in Personal Finance Are Booming in 2025

The need for positions in personal financial planning is driven by several important developments:

1. Rising Financial Complexity

People are now faced with investment apps, a variety of kinds of loans and credit scoring systems, retirement plans, as well as tax obligations. This increased complexity has heightened the need for specialists to simplify financial decisions.

2. Economic Instability & Inflation

Global instability has led people to seek out expert financial advice to secure their assets and prepare for unexpected events.

3. Digital Finance & Automation

Fintech tools have led to new job categories that combine finance and technology, such as automated advisor management and data-driven financial planning, along with digital wealth-coaching.

4. Massive Wealth Transfer

More than $80 trillion is predicted to pass through generations, opening up huge opportunities for planners, advisors, and wealth management.

In the end, jobs in personal financial management have a long-term impact with excellent job security and a high income potential.

What Are Jobs in Personal Finance?

” Jobs in personal finance” are professions that aid individuals to make well-informed decisions about savings, budgeting, investing in insurance, taxes, retirement planning, and wealth management. These positions are available at financial advisory firms, banks, as well as fintech-based startups, accounting firms, and insurance companies, as independent practices.

From beginning analysts to strategic wealth planners with high earnings, this industry provides opportunities for everyone at every level.

Core Skills Needed for Jobs in Personal Finance

To get one of the most prestigious positions in personal finance, professionals need to be able to:

- Analytical abilities in interpreting trends and financial data

- Communication skills – explaining complex information simply

- Thinking critically – making informed decisions for clients

- Standards of ethics for handling financial confidential information

- Tech proficiency, Use of CRM, financial platforms, and Fintech applications

- Customer relationship management creates trust and long-term relationships

Additional skills, like negotiation, sales, and behavioral finance, can greatly increase the chances of success.

Best Degrees & Certifications for Personal Finance Careers

While certain positions in financial services require only a bachelor’s degree, other jobs require additional certifications to ensure credibility.

Most Preferred Degrees

- Finance

- Accounting

- Economics

- Business Administration

- Financial Technology (Fintech)

Top Certifications

- CFP(r) – Certified Financial Planner

- CFA(r) – Chartered Financial Analyst

- CPA – Certified Public Accountant

- ChFC – Chartered Financial Consultant

- CLU – Chartered Life Underwriter

- FRM – Financial Risk Manager

These certifications can result in higher wages and quicker promotions.

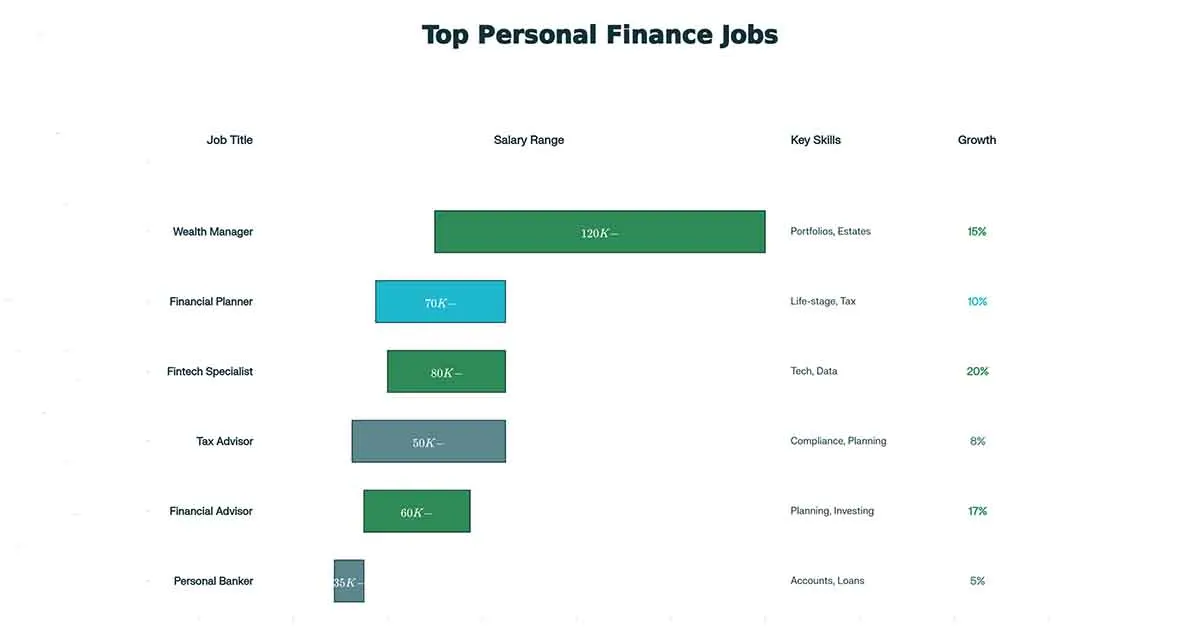

Top 15 High-Demand Jobs in Personal Finance (2025 Edition)

Here is a comprehensive overview of the most lucrative and sought-after positions in personal financial management, which includes duties, the roles they play, qualifications, and salary intervals.

1. Financial Advisor

The most well-known jobs in the field of personal financial management are financial advisors, who aid clients in financial planning as well as retirement, investing, and overall financial management.

Key Responsibilities

- Designing a unique financial plan

- Portfolio management

- Retirement analysis

- Investment guidance

- Recommendations for insurance

Salary Range

$60,000 to $150,000+ per year, dependent on experience and the client base.

Best For

People who have strong analytical and interpersonal abilities.

2. Financial Planner

Financial planners delve deeper into life-stage planning, such as the purchase of a home, financing for education, and estate planning.

Responsibilities

- Reviewing the financial goals

- Planning multi-year strategies

- Tax-efficient investment strategies

Salary

$70,000 $180,000 for professionals who are certified.

3. Wealth Manager / Private Wealth Advisor

They are top professionals working with wealthy individuals.

Duties

- Managing large investment portfolios

- Planning for estates and trusts

- Tax optimization

- Asset allocation

Salary

$120,000 to $400,000 or more, usually with bonuses for performance.

4. Credit Counselor

One of the primary tasks in personal financial management is that credit counselors aid clients in building credit and managing the burden of debt.

Responsibilities

- Plans for debt reduction

- Assistance for budgeting

- Discussions with the lenders

Salary

$40,000 – $70,000

5. Personal Banker

An ideal job that can be a gateway for newcomers to the financial world.

Responsibilities

- Opening accounts

- Offering advice on products from the banking sector

- Assistance with credit and loans

Salary

$35,000 – $60,000

6. Loan Officer / Mortgage Advisor

They aid clients with securing personal loans, home loans, and refinancing.

Responsibilities

- Evaluation of the borrower’s applications

- Offering loan options

- Controlling mortgage approvals

Salary

$50,000 – $120,000+

7. Financial Analyst

A surprisingly flexible work opportunity in finance for personal use, analysts use financial information to help guide decision-making in business and investment.

Responsibilities

- Creating financial models

- Analyzing market trends

- Making reports for advisors and executives.

Salary

$65,000 – $140,000

8. Insurance Advisor

Insurance advisors play a crucial role in securing clients from financial risk.

Responsibilities

- Selling insurance policies

- Evaluating risk levels

- Recommending health, life, or property insurance

Salary

$40,000 – $110,000, plus commission.

9. Tax Advisor / Tax Consultant

Tax professionals help people reduce taxes legally while making their financial decisions.

Responsibilities

- Making Returns

- Tax planning

- Monitoring that regulations are in compliance

Salary

$50,000 $80,000 – $180,000, depending on the certification and the area of specialization.

10. Retirement Planning Specialist

A rapidly expanding sector in work in the field of personal financial planning for a population that is aging.

Responsibilities

- Strategies for retirement income planning

- Social Security plan

- Allocation of funds to seniors

Salary

$70,000 – $160,000

11. Budget Analyst

Budget analysts can help organisations or individuals allocate resources effectively.

Responsibilities

- Creating budget plans

- Monitoring expenditure

- Recognizing financial improvement

Salary

$60,000 – $110,000

12. Fintech Advisor or Specialist

As fintech advances and expands, roles in hybrid tech-finance are becoming more important.

Responsibilities

- Helping users navigate digital finance tools

- Managing robo-advisor systems

- Data-driven planning

Salary

$80,000 – $180,000

13. Behavioral Finance Coach

They aid clients in overcoming their emotions that influence financial decisions.

Responsibilities

- Conducting training for the mind

- Examining the spending habits

- Coaching for a long-term plan

Salary

$50,000 – $130,000

14. Estate Planner

Estate planners make sure that the wealth transfer is smooth to the beneficiaries.

Responsibilities

- Making wills and trusts by writing

- Working with tax experts and lawyers

- In the design of inheritance strategies

Salary

$80,000 – $200,000

15. Financial Educator / Content Strategist

A rapidly growing area in online media and learning.

Responsibilities

- Teaching topics on personal finance

- Creating financial literacy content

- Working with institutions and brands

Salary

$40,000 – $120,000

Comparing the Top Jobs in Personal Finance

| Job Title | Education Needed | Best For | Income Level |

|---|---|---|---|

| Financial Advisor | Bachelor’s + CFP | Client-focused individuals | High |

| Wealth Manager | Finance degree + CFA | High-net-worth work | Very High |

| Personal Banker | Bachelor’s | Beginners | Medium |

| Tax Advisor | Accounting + CPA | Tax-oriented work | High |

| Fintech Specialist | Finance + Tech | Digital finance | High |

| Credit Counselor | Basic finance skills | Debt management | Medium |

This chart shows how broad the range of career options is for financial services jobs–from beginning-level positions to prestigious advisory roles.

Industry Trends Shaping Jobs in Personal Finance

Being aware of the latest trends will help job seekers to stay ahead.

1. AI and Automation Are Changing Advisory Work

Modern advisors use AI-powered tools to:

- Portfolio optimization

- Risk assessment

- Retirement simulations

- Behavioral insights

These tools can enhance the advisory role, but they don’t completely take away their advisory roles.

2. Growth in Remote Finance Jobs

A variety of work opportunities in personal finance–especially fintech, financial coaching roles, and planning–are completely online.

3. Demand for Ethical & Transparent Advisors

As the number of scams and false information increases on the web, consumers are more likely to seek credible advisers with a solid track record.

4. Younger Generations Need Financial Guidance

Gen Z and Millennials face distinct financial challenges:

- Student loans

- The costs of housing are increasing

- The stagnation of salaries

- Side-hustle income and complexities

This is causing demand for financial advisors who are knowledgeable about the current financial reality.

A Helpful External Resource for Career Planning

For beginners researching salary forecasts and job growth for jobs in personal finance, the U.S. Bureau of Labor Statistics offers extensive data:

https://www.bls.gov/ooh/business-and-financial

This external link gives important information about employment projections, along with wages and other requirements for careers in finance.

How to Start Your Career in Personal Finance

Here’s the best way to get started:

1. Choose a specialization

Find out if you are a fan of tax-related planning, investing analysis, or interaction.

2. Develop the fundamental knowledge

Begin by taking finance or business classes online or via degree courses.

3. Earn relevant certifications

CFP, CPA, CFA, and other credentials increase credibility.

4. Get practical knowledge

Internships, banking positions, and entry-level analyst positions are typical starting points.

5. Create your own personal brand

The creation of financial content or social networking through LinkedIn improves the credibility of LinkedIn.

6. Keep up-to-date with the latest developments

Technology is continually changing financial jobs and personal finance, which makes continuous learning crucial.

Salary Expectations for Jobs in Personal Finance

Salary ranges based on qualifications, experience, and specialization.

Entry-Level

$40,000 – $65,000

Mid-Level

$70,000 – $150,000

Senior-Level / Certified Advisors

$150,000 – $400,000+

Wealth Managers / Partner-Level Roles

$250,000 – $800,000+

The work of advising often involves commissions, bonuses, or performance-related incentives.

Is a Career in Personal Finance Right for You?

You’re a good fit for work in personal finance. If you

- Enjoy helping people

- They are highly analytical and have excellent communication abilities.

- Are you comfortable with numbers?

- Explain complex concepts easily

- You want stability in income and long-term growth?

- Work that is ethical and focused on the client

The industry is growing and is a great job choice over the next decade.

The Future of Jobs in Personal Finance (2030 Outlook)

By 2030, experts predict the financial services industry for individuals to be even more technologically driven, transparent, accountable, and customer-centric. AI will assist human advisors, not replace them. The demand for financial literacy will increase across workplaces, schools, and institutions.

Professionals who can adapt to the latest trends, embrace technology, and adhere to high ethical standards will succeed.

Final Thoughts

The vast world of careers in personal finance is full of opportunities, from basic positions to highly paying management positions. You can assist families in planning their futures or assist people who struggle with debt or manage multimillion-dollar investment portfolios; there’s a career suitable for your abilities and goals.

With the strong growth rate, high pay, and a growing demand, 2025 is a great moment to get into the field.