Have you ever looked at your account in the middle of the month and wondered where all your money went? You’re not the only one. The majority of people slog through their paychecks and then feel a bit broke on Friday. This is where your personal cash flow is your simple reality check. It’s the amount of money flowing into your account, minus the money flowing out – your salary, any side jobs, groceries, rent, and that sneaky habit of coffee. Get this right, and suddenly you’re not just surviving; you’re stacking cash for dreams like travel or early retirement.

Don’t take note of your personal cash flow, however, and you’re playing the game of financial roulette. As debts accumulate, emergencies strike with the force of a truck, and the goals are lost. I’ve seen friends go after six-figure careers but end up broken because they did not track how much money they had in their individual cash flows. This in-depth look at personal cash flow pulls back the veil to reveal what it is and why it’s more important than your pay and proven strategies to turn negative flows to positive ones. Stay tuned–you’ll leave with the ability to manage your money.

The Reasons Your Bank Balance is False (And personal cash flow is the truth)

Think that your salary is the sole measure of the amount of wealth? Rethink that. A large salary can mean nothing when expenses consume it. The personal cash flow exposes the truth. Are you creating wealth or are you squeezing it dry? Imagine two friends earning around $80k a year. One monitors the personal cash flow and, while saving 20%, invests intelligently. Another? Impulse purchases and subscriptions eat into the cash in his wallet, leaving him in debt. In five years, the tracker acquires a home while the shopper rents out for the rest of his life.

This isn’t just a theory. Research shows that households that have positive financial flow have emergency funds that grow 3 times quicker and retire with a 40% larger nest egg. Why? Personal cash flow forces honesty. It can spot leaks such as unpaid gym membership fees ($50/month? That’s $600 yearly!) or dining out ($200/week? Ouch.). Companies rely on cash flow statements. Your wallet is entitled to the same treatment. In the absence of it, you’re traveling in the dark, with no plan for your trips, kids’ college or that side hustle you want to that you’ve been working on.

Real talk: in the current economy, inflation is at the heels, while wages are lagging. Personal cash flow management isn’t an option; it’s essential for survival. Keep track of it every month and rest better, being in control.

Breaking down the personal flow of cash Cash Flow: Income In expenses Out

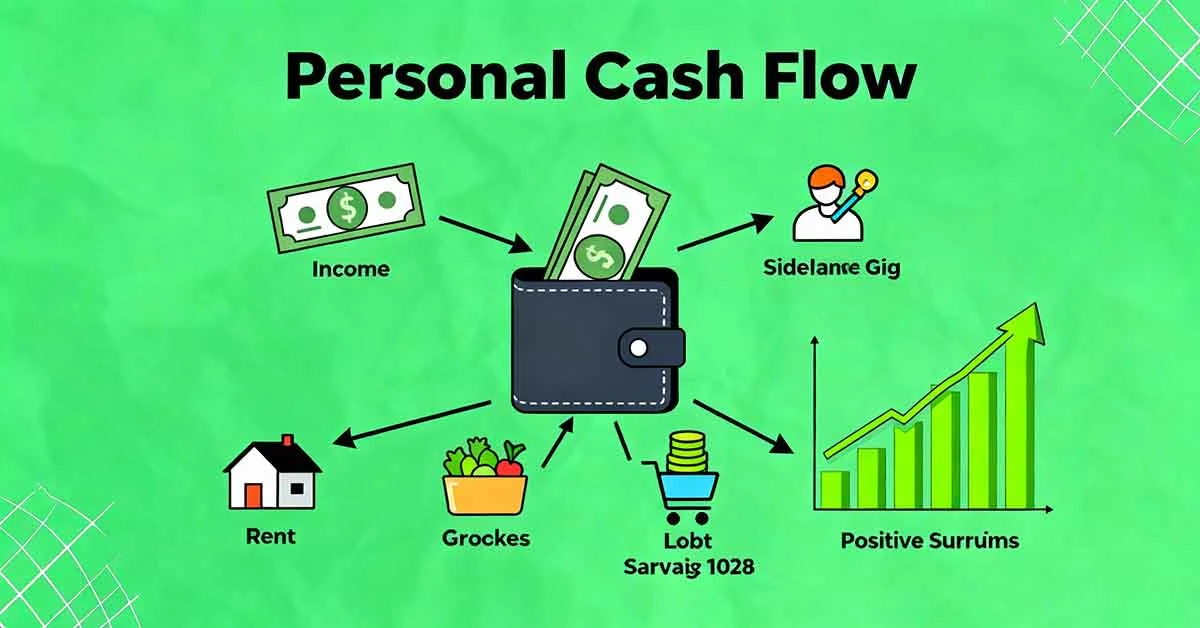

At its heart, personal cash flow is the sum of Total Inflows and Total Outflows. Positive? You’re winning. Negative? It’s time to tweak. Let’s dissect.

Inflows are all the cash that comes into your accounts:

- Pay or salary (post-tax take-home)

- Side hustles (freelance, ridesharing)

- Passive income (dividends, rentals)

- Bonuses, refunds, gifts

Do not miss anything, even that birthday $20 Venmo is counted. Try to find a variety of streams; one job can be risky when laid off.

Outflows broken down into fixed (predictable problems) as well as variables (flexible solutions):

- Fixed: Rent/mortgage ($1,500? ) or loans ($400 car loan), Insurance ($150), and utility bills ($200).

- Variable: Groceries ($400), gas ($100), dining ($300), entertainment ($150), shopping ($200).

Net Cash Flow is the sum of outflows and inflows. $5,000 in, $4,200 out? +$800 surplus. Do you want to reverse it? A red flag is to dip into credit or savings, which can lead to more trouble.

Tools make life easier: apps like Mint or YNAB automatically categorize. You can also use spreadsheets. For more in-depth information, you can pair it with an account of net worth (assets and liabilities). The personal cash flow displays each month’s movement, and net worth is the overall standing. Together? Unbeatable.

Create Your Personal Cash Flow Statement Step-by-Step Blueprint.

Are you ready to do it yourself? Take a cup of coffee, a spreadsheet, and three months’ worth of statements. Here’s a no-nonsense guide.

- Gather Information: Pull bank apps or credit cards, as well as pay receipts. Notify each transaction.

- List Inflows: Compile monthly mean amounts. Salary: $4,500. Gig: $300. Investments: $100. Total: $4,900.

- Detail Outflows: Categorize ruthlessly.

| Category | Fixed | Variable | Total |

|---|---|---|---|

| Housing | $1,800 | – | $1,800 |

| Food | – | $500 | $500 |

| Transport | $300 | $150 | $450 |

| Debt | $400 | – | $400 |

| Fun | – | $400 | $400 |

| Total | $2,500 | $1,050 | $3,550 |

- calculate net: $4,900-$3,550 = $1,350. Celebration… Or alter.

- Project Forward: Factor raises, bill hikes. Tools such as Vertex42’s Cash flow templates make this easier.

Review quarterly. Life changes: job loss, birth, and increase. You should update your individual cash flow statement to ensure you are ahead—a tip to consider savings as a “must-pay” cash flow. First, you need to make an outflow. Boom–instant positive flow.

Red Flags in your Personal Cash Flow Spot Trouble Early

A negative financial situation shouts, “Fix my problem!” The most common culprits are:

- Lifestyle Creep Promotion? New gadgets come along. Limit it.

- Subscription Trap: The combination of gym and Netflix is a $100+ per month black hole.

- Impulse Purchases: Amazon cart? Wait 48 hours.

- Without a Buffer, the one-car repairs can wipe you clean.

Warning signs: Living paycheck-to-paycheck, maxed cards, skipped savings. Fast-track to 30 days and cut 10% of the variables. The personal cash flow transforms victims into winners.

10 proven hacks to boost your Cash Flow

Theory is fine, the action wins. Here’s what works, taken from real people who’ve managed to escape the broken cycle.

- Auditing Ruthlessly: One month, record all the data. There are a lot of surprises to come, such as $15/week coffee ($780/year! ).

- 50/30/20 Rule: 50% needs, 30% wants, 20% savings/debt. Fits most budgets.

- Negotiate Charges: Call cable, insurance, and save $50/month.

- Meal Prep: Home cooking halves food costs. The Sunday batch is a great way to save money.

- Side Hustle Smart: Drive Uber weekends? $500 extra inflow.

- Auto Save: Pay yourself first–$200 to save on your payday.

- Debt snowball: The smallest balances are first to generate momentum.

- Cash envelopes. The jars are empty, and the variable is gone. They are empty.

- Invest Surplus: High-yield savings (5 percent APR?) beats bank drag.

- Review Weekly: Sunday ritual keeps you honest.

These aren’t tricks. One participant cut down on dining by 50%, boosted personal cash flow by $400/month, and financed a European trip. Small victories add up. To learn more, read Ramsey Solutions’ cash flow tips.

Advanced Personal Cash Flow Plays Level Up to Wealth Builders

Beginners track; pros optimize. Inconsistent earnings (freelancers)? The average of three months and buffer levels are low. Families? Allocate per person.

Taxes eat away at the personal financial stream–max the retirement account (401k and an IRA) to deduct taxes. Real estate? Rentals can boost cash flows post-down payment.

Hacks for tech: Empower apps to forecast your personal financial flow; Monarch budgets couples. Businesses make use of QuickBooks and can be adapted to personal use.

Long-game: A positive private cash flow creates compound interest. $500/month at 77%? $1M over 40 years. Mind-blowing.

The most common Personal Cash Flow Myths Uncovered Wide The World Wide Web

Myth 1: “High income = good individual cash flows.” Nope–lotto winners go broke.

Myth 2: “Budgets can stifle freedom.” False, your personal financial flow monitoring lets you worry less.

Myth 3: “Too complicated.” Five minutes a week is enough.

Myth 4: “Savings in the future.” Inflation is saying now.

Take them down, prosper.

Your Cash Flow is your own personal Strategy: Begin Today.

Check this list:

- Build statement (Week 1)

- Cut 10% variables (Week 2)

- Add $100 inflow (Week 3)

- Automate savings (Week 4)

- Review monthly

Record 90 days of progress; post the results in comments. Cash flow in your personal life isn’t sexy; it’s essential. Learn it, and financial independence will follow. You’ve got the plan. Now you can execute.