In 2026, experts are looking for the highest ROI investments for beginners in 2026 that combine growth with simplicity. With the market evolving with AI booms and green energy changes, and economic growth, now’s the right time to start looking. This guide explains it all in plain English–no words, just concrete steps.

Forget get-rich-quick schemes. The real highest ROI investments for beginners in 2026 are focused on building up over time. Expect annual returns of 7 to 12% from assets that have proven themselves to beat inflation completely.

Why 2026 Is Your Golden Year for Highest ROI Investments

Markets in 2026 could be stable after 2025’s volatility. Inflation slows, rates fall, and tech is driving growth. Beginning investors who are looking for the highest ROI investments for beginners in 2026 will be able to ride the trend.

Recent data suggests that portfolios that are diversifiable outperform 90 percent of active traders. Begin small and build up to six figures over the course of decades.

Risk? It is manageable through education. This article focuses on beginner-proof options that will provide the top high ROI investments for newbies in 2026.

Myth-Busting: How to Determine What “Highest ROI” Really Means for Newbies

The most profitable investments for those who are just starting in 2026 aren’t crypto-gaming or penny stocks. ROI is the term used to describe the net return on the risk, fees, and taxes.

For novices, set a goal of 8-15% for averages over the long term. Top performers like Bitcoin have crashed by 70% in previous cycles, which is not a good choice for beginning traders.

Make sure you prioritize liquidity, low fees (<0.2 percent), and diversification. These are the foundations of the highest ROI investments for beginners in 2026.

*#1 Option: Index Funds – The silent ROI Poweruse

Index funds track the markets, such as the S&P 500. They’re without doubt the best of the highest return on investment for those who are just starting in 2026.

Why? The cost is low (0.03-0.1 per cent fees) and instant diversification across 500 of the top US companies. Past 10-year average: 12% ROI.

2026 In 2026 2026, with AI and renewables on the rise, S&P funds shine. Vanguard’s VOO or Fidelity’s XAIX.

Pro Tip: Dollar-cost average $200/month. In 2036, that’s $50K+ with 10 10% ROI.

Beginning students love hands-off growth. No stock-picking stress.

Also read – What is Personal Finance? A Complete Beginner’s Guide

Real Returns Index Funds against. Savings accounts

Savings yield up to 45% in 2026. Index funds? Double it historically.

| Investment | Avg. Annual ROI | Risk Level | Beginner Fit |

|---|---|---|---|

| Index Funds | 10-12% | Medium | Perfect |

| Savings | 4-5% | Low | Safe but slow |

| Individual Stocks | 15%+ | High | Avoid early |

Index funds are awarded the highest ROI investments for beginners in 2026.

ETFs: Flexible Cousins of Index Funds to Maximize ROI

Exchange-Traded Funds (ETFs) are traded as stocks; however, they mirror the indices. The top investment options with the highest ROI for new investors in 2026 are VTI (total US market) and VXUS (international).

2026 trends Sector ETFs in AI (like BOTZ) or clean energy (ICLN) could reach 15 to 20 percent ROI.

Fees? In the range of 0.1 percent. The liquidity is unbeatable. Buy or sell at any time.

Beginner hack: Pair 70% broad ETF and 30% thematic, to get the highest ROI for newbies in 2026.

Bonds and Treasuries: The Safety Net for Boosting ROI

Don’t be asleep on a fixed income. US Treasuries and bond ETFs such as BND have yields of 46% in 2026 and offer almost zero risk.

To get the best ROI on investments for those who are just beginning in 2026, Mix bonds/stocks 80/20. Slashes volatility, preserves gains.

TIPS guard against inflation. Ladder maturities ensure a stable income.

Yields rise when the Fed pauses – perfect timing.

Dividend Stocks & Aristocrats: Passive Income Rockets

Dividend King pays quarterly cash. Coca-Cola and Procter & Gamble – 50+ years, increasing dividends.

Aim for a 3-5% yield plus 7 percent growth = 10-12 percent ROI. The ideal high ROI investment for those who are just starting in 2026.

ETFs similar to SCHD include 100plus Aristocrats. Reinvest dividends for compounding magic.

In the mature bear market, they will shine.

REITs Real Estate ROI, Without the Hassle

Real Estate Investment Trusts own properties and pay 90% of the dividends. VNQ ETF yields 4% plus appreciation.

2026: A housing boom? REITs could provide an ROI of 12. Low entry, no tenants ($50/share).

Highest ROI investment options for new investors to 2026 include REITs in data centers (digital property).

The diversification process is seamless and transcends stocks.

Crypto Caution: High Returns, High Risk for Beginners

Bitcoin ETFs such as IBIT offer crypto exposure that is regulated. 2026’s halving could trigger up to 50%+ of runs.

However, volatility can kill. It’s 50% typical. Limit your portfolio to 5.

Not the core best ROI investment for those who are just starting in 2026, but a smoky satellite.

Robo-Advisors: Automatic Route to the Highest ROI

Platforms like Wealthfront and Betterment build portfolios for you. Algorithms optimize to provide the highest ROI for investments made by novice investors in 2026.

$500 minimum. Tax-loss harvesting boosts returns 1%.

Set risk level, auto-rebalance. Hands-free 8-10% ROI.

Target-Date-Funds: Set-It-and-forget-it ROI Machines

Vanguard Target 2060 Fund automatically adjusts to retire. The fund is aggressive at first, but then becomes more moderate.

The perfect choice for the highest ROI investments for beginners in 2026. 9-11 percent historical blends.

One-fund rule of simplicity.

Gold & Commodities: Inflation-proof Return Shields

GLD ETF tracks gold. 2026 geopolitics? 10%+ upside.

5-10% allocation hedges stocks. Long-term return of 7-9 percent.

It is a good complement to portfolios that are heavily invested in equity.

P2P Loans: High Yields and Sky-High Yields for brave beginners

Platforms such as LendingClub provide 7-12% on loans. Choose from a variety of 100+.

Risk defaults, but 2026 rates favor lenders.

A tiny portion of the highest ROI investment options for new investors in 2026.

Trends that are Emerging in 2026 Supercharging ROI

AI stocks via QQQ. Green bonds. Tokenized assets.

Be broad, but shift 10% towards trends to get the best ROI investment for those who are just starting in 2026. kick.

Step-by-Step Guide to The 2026 Year of the Highest ROI Portfolio

- The Emergency Fund is the first six months of expenses within HYSA.

- Open Brokerage: Fidelity, Vanguard–zero commissions.

- Core (70 percent): S&P ETF + Total Market.

- Income (20%): Dividends/REITs.

- Growth (10 percent): Thematic ETF.

- The investment is Monthly: Automate DCA.

Track using apps like Personal Capital.

Risk Management: Protect Your Highest ROI Gains

Diversify assets across 5+. Rebalance each year.

Avoid FOMO buys. Averages of cost per dollar peaks and troughs.

An emergency fund helps prevent forced sales.

Tax Hacks Maximizing 2026 ROI

Roth IRA: Tax-free growth. Contribute $7K per year.

401(k) matching: No money and 100% ROI in a matter of minutes.

You can hold 1+ years to secure long-term capital gains (15 percent tax).

Common Beginner Mistakes Killing ROI

Chasing hot tips. Selling panic. High-fee funds.

Don’t overlook these for the highest ROI investments for beginners in 2026.

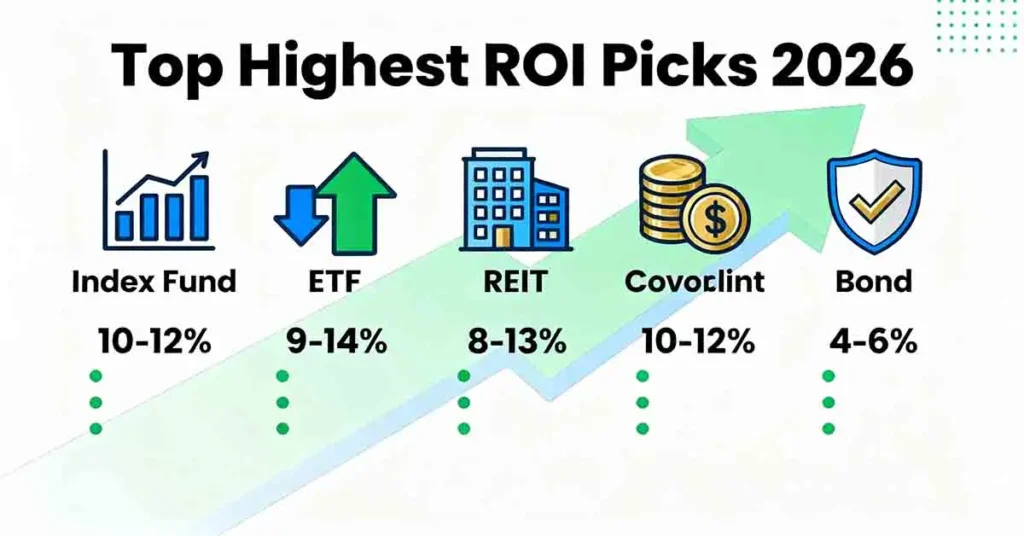

Expected Returns on Investment 2026 projections that are realistic

- Index Funds 10-12%

- ETFs: 9-14%

- REITs: 8-13%

- Bonds: 4-6%

- Blended Portfolio 9-11 percent

The compounding process turns $10K into $100K over 25 years, at 10 per cent.

Apps and Tools to help Beginner Investors in 2026

Robinhood offers free trades.

Acorns: Micro-investing.

Yahoo Finance Trackers.

Empower portfolio analysis.

The 2026 Economy Outlook: Growing These Investments

Fed cuts fuel stocks. AI capex increases. Real estate rebounds.

There are positives to the best ROI investments for new investors in 2026.

Success Stories: Beginnings in securing the highest ROI

Jane 26, DCA’d VOO, since 2020. $50K, now $90K.

Mike added REITs — 12% average ROI.

Whose are next?

Last Playbook: Begin Your Most Exciting Return on Investment Journey Now

Choose 3 from this list. Start with $100.

Consistency = perfection. 2026 awaits.

The highest ROI investments for beginners in 2026 are available now. Claim yours.